People have a tendency to become creatures of habit. They might travel to work the same way every day, order the same pizza toppings every Sunday evening, and buy the same brand of tennis shoes. They have just become accustomed to a habit because it is familiar.

Just as it’s not a bad idea to try mushrooms instead of pepperoni on your pizza or to take a new and scenic route home from the office, it’s also a good idea to look into alternatives to traditional banking.

There’s a lot to think about in the evolving world of personal finance, from fintech to mobile banking and from money market funds to peer-to-peer lending institutions. To make your life easier, here are four alternatives to traditional banking.

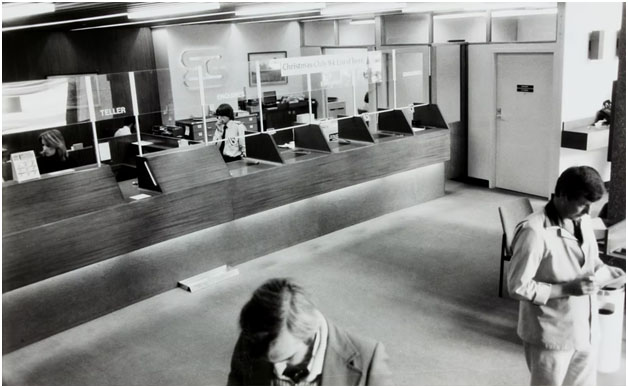

Traditional banking was founded on the concept of capital creation. Typically, traditional banking institutions rely on clients putting money into the banking system and then lending those funds to other customers in the form of loans and mortgages. Borrowers pay fees and interest on the money they borrow, which produces capital and earnings for the bank.

Customers can stroll into a bank and deposit or withdraw funds, borrow money, and take advantage of a variety of additional services. However, customers can now complete all of these operations online while sticking to a traditional banking system.

A user can make financial transactions through the internet by using online banking. Online banking can also be referred to as internet banking or web banking.

Customers can use internet banking to access practically every function that was previously available only at a local branch, such as deposits, transfers, and online bill payments. Almost every banking institution offers some type of internet banking, both on desktop and through mobile apps.

Most fundamental banking transactions may now be completed online, eliminating the need for customers to visit a bank location. They may accomplish all of this whenever and wherever it is convenient for them—at home, at work, or on the go.

Typically, you can pay bills, ask for an online installment loan, transfer funds, deposit checks, and check transactions and account balances.

There is no need to visit a bank branch, and you may complete all of your banking needs whenever it is most convenient for you, including outside of typical banking hours.

Obtaining a loan is usually a time-consuming and paper-intensive procedure, but it does not have to be. Filling out your application online expedites the credit-check process, allowing your bank or credit union to respond more promptly.

Some financial institutions with online loan applications make funds available the same day you are authorized for a loan. Other lenders that operate purely online can make lending decisions almost instantly.

A credit union is a financial cooperative that offers standard banking services. Major firms, organizations can find credit unions, and other entities for their employees and members. They can range in size from small, volunteer-only operations to large enterprises with thousands of participants across a given region.

Credit unions are founded, owned, and operated by their members. As such, they are non-profit organizations with tax-exempt status. Credit unions operate on a simple economic model: members pool their money (technically, they purchase shares in the cooperative) to provide loans, demand deposit accounts, and other financial products and services to one another. Any revenue earned is utilized to fund programs and services that serve the community and its members’ interests.

Peer-to-peer lending (Also, P2P lending) is an online system in which individual investors fund loans (or portions of loans) to individual borrowers. Peer-to-peer lending, often known as marketplace lending, is a rising alternative to traditional lending.

This loan mechanism benefits both borrowers and lenders. Some applicants, for example, may be able to acquire a personal loan after being declined by other lenders.

Such peer-to-peer lending services may be a useful alternative to payday loans or credit cards for some people.

Depending on your credit, you may be eligible for a low interest rate. People with poorer credit scores, on the other hand, are likely to face higher interest rates – often much more than the average credit card interest rate.

Neobanks, often known as “challenger banks,” are fintech companies that provide applications, software, and other technologies to simplify mobile and internet banking. A neobank is entirely digital, relying on apps and online platforms to service consumers rather than traditional physical locations.

These fintechs typically specialize in specific financial products such as checking and savings accounts. They are also more agile and transparent than their megabank counterparts, despite many of them collaborating with such institutions to ensure their financial products.

There are numerous possibilities for people looking for a different method to bank. Digital banking is all about convenience, and very few individuals want to stand in long lines at the bank to do their banking.

Alternative banking, on the other hand, entails far more than just deposits and withdrawals. You can simply pay your bills, transfer payments to family and friends, purchase online, and perform a variety of other transactions.

These services have made it easier to save, spend, and invest, and most individuals can manage their financial portfolio from any smartphone app or computer. Many alternative banking systems have been developed expressly for business professionals to pay contractors or receive payments from clients.

While both alternative and traditional banking has advantages and limitations, there are undeniable benefits to each. The good news is that there is no reason why you can’t use both to manage your finances.

Disclaimer: This is a paid article. KryptoMoney does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company. KryptoMoney is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in the article.

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.