Ethereum (ETH), the second-largest crypto asset, from a basic point of view is undoubtedly inside one of its crucial moments ever. Recently ETH daily transaction count hit the 1 million mark while its userbase has grown immensely.

The value of ETH locked in DeFi applications surged to $1.65 billion with a rise of 65% seen in the last twelve days. All of the gains seen within the Ethereum ecosystem have thereof been confined to the burgeoning DeFi sector as ETH price remained unaffected.

The number of Ethereum holders also recently hit a fresh all-time high, Glassnode indicates that Ether addresses with non-zero balance hit highs of nearly 42.4 million addresses.

Holders of Ethereum Hit Fresh Highs (Source: Glassnode)

Holders of Ethereum Hit Fresh Highs (Source: Glassnode)The spike in the number of Ethereum holders seems to be driven by the buying pressure created by ETH Miners which came subsequently after a bout of short-term Miner sell-offs in late May and early June when ETH surged above $220.

Now, ETH mining pools have seen a balance spike by 21,000 ETH within twenty days time span. With ETH currently trading beneath $230, Miners are confident that this period is presenting ample opportunities to make gains.

ETH/USD Daily Chart

ETH/USD Daily ChartEthereum is currently trading at $227, after recovering from the lows of $215 it set a few days ago.

Early Sunday afternoon, reports began to filter through social media that a DeFi hack had occurred. As stated by 1inch, Ethereum-based decentralized exchange, more than $500,000 worth of Ethereum and other Altcoins were stolen. The Block’s Steven Zheng states:

“Apparently someone drained a Balancer Pool made up of WETH and STA and got away with $500k worth of WETH,

This recent hack may be a setback to DeFi’s growth.

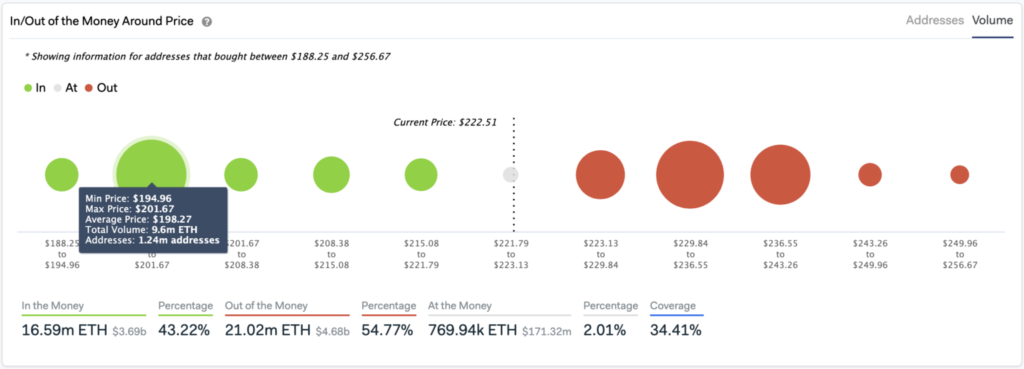

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model gives a picture of ETH’s recent state.

Here it indicates ETH is trading above a weak support level which may cause it to tumble. It gives this range to be between $215 and $221 indicating that nearly 1 million addresses had previously purchased 1.6 million ETH around this zone. If this supply wall gives way, Ethereum could decline to $200 since there is not any major resistance in between.

Ethereum Stays Above a Weak Support (Source: IntoTheBlock)

Ethereum Stays Above a Weak Support (Source: IntoTheBlock)The fact that 1.24 million addresses had previously bought 9.6 million ETH around the $200 support level might constitute as strong support. Buying pressure from holders within this price range will prevent ETH from further decline.

There are no absolutes in this kind of scenario based on the unpredictability of the crypto market, but the fact remains there is a massive supply wall ahead of Ethereum that may soak in any upside pressure.

The IOMAP indicates that the $230-$243 range might constitute a huge resistance wall as 2.7 million addresses had previously bought over 15 million ETH.

However, not only this, Ethereum transaction fees which recently hit a two year high is also a source of concern amongst investors.

Image Credit: IntoTheBlock, Glassnode, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.