Sometime during the Q4 last year, Ripple (XRP) managed to successfully place itself as the second-largest cryptocurrency, however, a crypto research firm Messari makes a different claim. The firm alleges that ripple’s circulating market caps is “significantly overstated”.

A quite bold thesis of a new report Messari, states that the combined value of all liquid XRP tokens is “significantly overstated”on a vast majority of crypto data services and exchanges, as much as 46 percent.

According to Messari, the current circulating market cap of ripple is $6.9 billion, making it the third-largest cryptocurrency behind both bitcoin ($62.9 billion) and ethereum ($12.2 billion). This illustrates a very contrasting picture that is available on most third-party crypto data feeds.

CoinMarketCap, a website ranked amongst the 500 most-visited websites in the world according to Alexa, estimates that the value of all XRP in circulation is a little over $13 billion. CoinGecko, another popular crypto data service reports it to be it slightly lower but still well above the $12.9 billion mark. The CCN’s market cap page, based on data from TradingView, pegs the token around this mark as well.

According to all three services, the ripple is the second-largest cryptocurrency. However, Messari claims that the Ripple company, which owns the majority of XRP does not give a piece of accurate market information through its XRP data API.

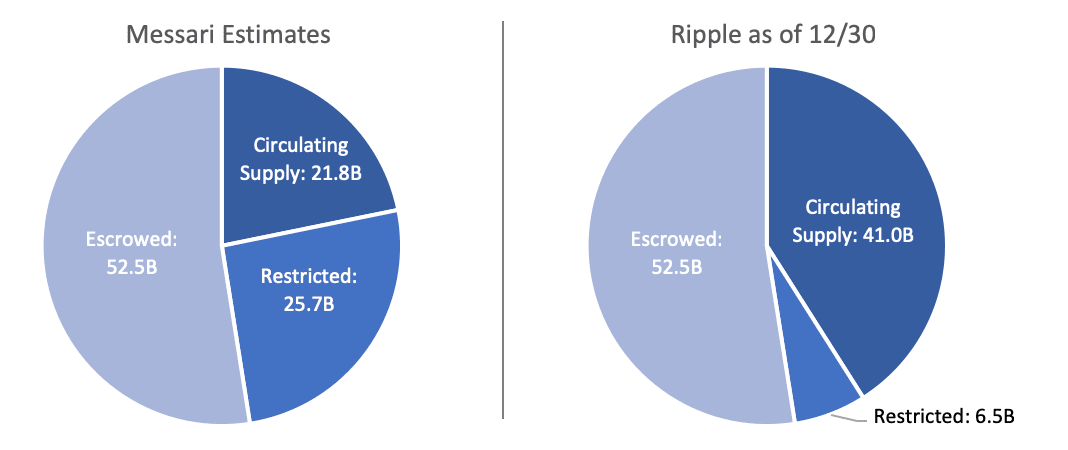

The research claims that in addition to the 59 billion XRP that Ripple owns are mostly held in escrow and only some are available for restricted sales, the company has distributed billions of XRP to people or organizations who have agreed to contractual restrictions on selling them.

While some of these agreements have been disclosed, for instance, co-founder Jed McCaleb, Messari alleges that others have not. Altogether, as much as 19.2 billion XRP worth $6.1 billion may be inaccurately included in ripple’s circulating supply.

From the report:

Combined, this means 19.2 billion of the 41.0 billion XRP currently quotes as “in circulation” may be illiquid or subject to significant selling restrictions. In reality, this estimate may prove to be conservative, as they belie XRP trading volumes which have consistently fallen well below that of EOS and Litecoin, two crypto assets whose current referenced market caps are a mere 17% and 15% of XRP’s, respectively. In addition, we believe the actual amount of “restricted” XRP in distributions to investors, banking partners, and team member may be significantly higher than our initial estimates reflect.

Market cap can be a controversial metric, that can be unscrupulously used by the token developers to make their crypto appear more valuable than they really are. However, it is one of the simplest and most convenient ways to rank the assets within the cryptocurrency ecosystem.

If XRP’s market cap is portrayed to be larger than it is, then shareholders aren’t getting a fair deal upon trading their funds. Furthermore, going by the thesis’ finding, that billions of XRP are being held by entities who are contractually restricted from selling them, the token may face “persistent sell-side pressure,” above and beyond what has been publicly disclosed by the Ripple company and its affiliates.

The researcher wrote in the report:

“We urge Ripple to disclose its volume-based selling methodology, as well as the amount of XRP subject to contractual volume-based selling limitations over time. This is necessary in order to help investors better understand the inflation and selling pressure in one of the industry’s largest assets, and is necessary to protect consumers and promote fair and efficient crypto markets.”

A Ripple spokesperson, said in response to an emailed inquiry from CCN, that Messari has allegedly based the report on “several inaccurate assumptions” as well as “an incorrect calculation of market cap.”

Not only does this report contain several inaccurate assumptions around lockups and selling restrictions, the entire report is based on an incorrect calculation of market cap. While decentralized digital assets like XRP are different from traditional equities, the term ‘market cap’ is always a very simple calculation: current price X total number of the asset = market capitalization. That puts XRP’s current market cap at approximately $31 billion. We believe that any other calculation of market capitalization for XRP is not a clear representation of the truth.

However, observing other blockchain data, the Messari claim might have some merit. For instance, new research published from LongHash, illustrates that over the past week, the Ripple’s network had a median number of daily active addresses of just 5,204.

With the stat being 99.12 percent less than bitcoin’s median of 592,090 active addresses and significantly lesser than tokens with smaller market caps, ethereum, EOS, and bitcoin cash, it does seem to raise some questions. Noting that network activity isn’t directly related to crypto market cap, it seems odd that a large value of the token is assigned to so few users. Even after adding that XRP’s focus it towards enterprises, don’t such users send more funds than the average user on other networks. All in all, we agree with the researcher and Ripple need to address some questions.

Read More: Overstock’s Cryptocurrency Subsidiary Platform, tZERO Begins Live Trading

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.