In the last few weeks, there has been a massive portrayal of bullishness for the top crypto asset by market cap, Bitcoin. First, the Grayscale Bitcoin Trust recorded massive adoption rates recently, causing it to trade at a massive premium over spot Bitcoin. GBTC’s premium may also be steered by growing demand for Bitcoin amongst institutional investors.

Second, weeks after Bitcoin’s halving event, data gathered by on-chain analytics Glassnode depicted “weaker” miners might have sold all their digital BTC holdings.

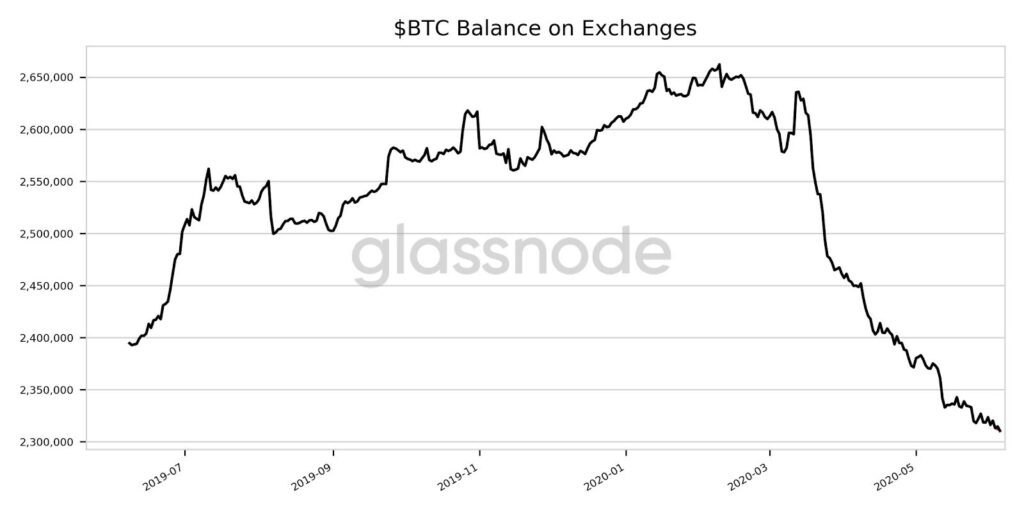

Third, as seen in Glassnode data, Bitcoin reserves on cryptocurrency exchanges plunged to a year low, signaling an accumulation of BTC by investors. Exchanges balance hit a 1-year low of 2,310,466,600 BTC as indicated in recent Glassnode data.

$BTC Balance on Exchanges. Source: Glassnode

$BTC Balance on Exchanges. Source: GlassnodeThis correlated with the reported mass outflow of BTC from Coinbase in the news wake that Coinbase intended selling its blockchain intelligence arm Coinbase Analytics to the Internal Revenue Service (IRS) and the Drug Enforcement Agency (DEA). The reported rise in BTC withdrawals from Coinbase seemed to indicate that investors are worried the deal may put their user data un a precarious state.

Since March 2020, the outflow of Bitcoin from cryptocurrency exchanges has been steadily rising indicating investors are less likely to sell their BTC holdings in the near-term.

At the moment, Bitcoin trades at $9,715.

The reason why the drop in Bitcoin reserves is significant is based on the fact that from historical antecedents, exchange reserves plummet when Bitcoin is ushered into an accumulation phase. For instance, in early 2019 when Bitcoin rose steadily from near $4,000 to $14,000 the balance of Bitcoin on exchanges fell significantly.

Some analysts opine that the massive outflow from cryptocurrency exchanges is a bullish coin metric that may influence medium to long-term price activity of Bitcoin (BTC).

This is because over time if massive outflow from crypto exchanges persists, buying demand will eventually outweigh selling pressure leading to a surge in BTC price coupled with the fact that sell-offs from Bitcoin miners will be drastically reduced.

BTC/USD Daily Chart

BTC/USD Daily ChartAnalysts have predicted that if the downtrend in exchange balance extends into the near term, it will increase the chances of BTC entering a real accumulation phase that may catalyze a bull run.

Recent data from skew indicated that Bitcoin options trading is growing at a faster rate than the futures and swaps market. Compared with the ratio of aggregate open interest in the Bitcoin options market to open interest for Bitcoin futures and swaps, a distinct uptrend is seen from January 2020 to date.

Image Credit: Glassnode, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.