Ethereum (ETH) price is climbing higher, hitting all-time highs of $2,145 on Friday. Ethereum rallies on the back of the favorable technical structure and underlying fundamental strength following a high-profile announcement from Visa.

Ethereum recorded eight green candles within the past nine days, as it climbed from lows of $1,545 on Mar. 24 to the $2,137 price witnessed at the time of publication. The majority of Altcoins also rose in tandem with most crypto assets especially in the top 50, trading in the green as at when writing.

This time, Bitcoin isn’t taking the lead in the cryptocurrency market price action as it briefly rose to $60,055 before a slight retreat. On a 24 hour and 7-day basis, gains in Bitcoin (BTC) appear lean in comparison with Ethereum (ETH). Ethereum is up 9.13% in the last 24 hours and 25.99% on a 7-day basis while Bitcoin is barely up $0.46% in the last 24 hours and 8.10% weekly to trade at $59,095.

While Bitcoin grapples with the $60k resistance, Altcoins have remained in the spotlight rallying to new highs. A trader who goes with the Twitter name, @rekt capital noted ”Since successfully turning its 2017 Highs into support… Altcoin Market Cap has rallied +48% in 38 days, It has been in an uninterrupted uptrend for 9 days now And has been making new all-time highs for 5 days straight. This is history in the making…”

The ETH/BTC pair continuously stagnated in the previous month while trading beneath a key downtrend line. Now, the ETH/BTC pair has broken out for the first time since mid-February as Ethereum rallies to highs of $2,145. Although ETH/BTC saw a strong technical breakout, the uptrend has been buoyed by strong fundamental catalysts, supporting ETH’s near-term bull case.

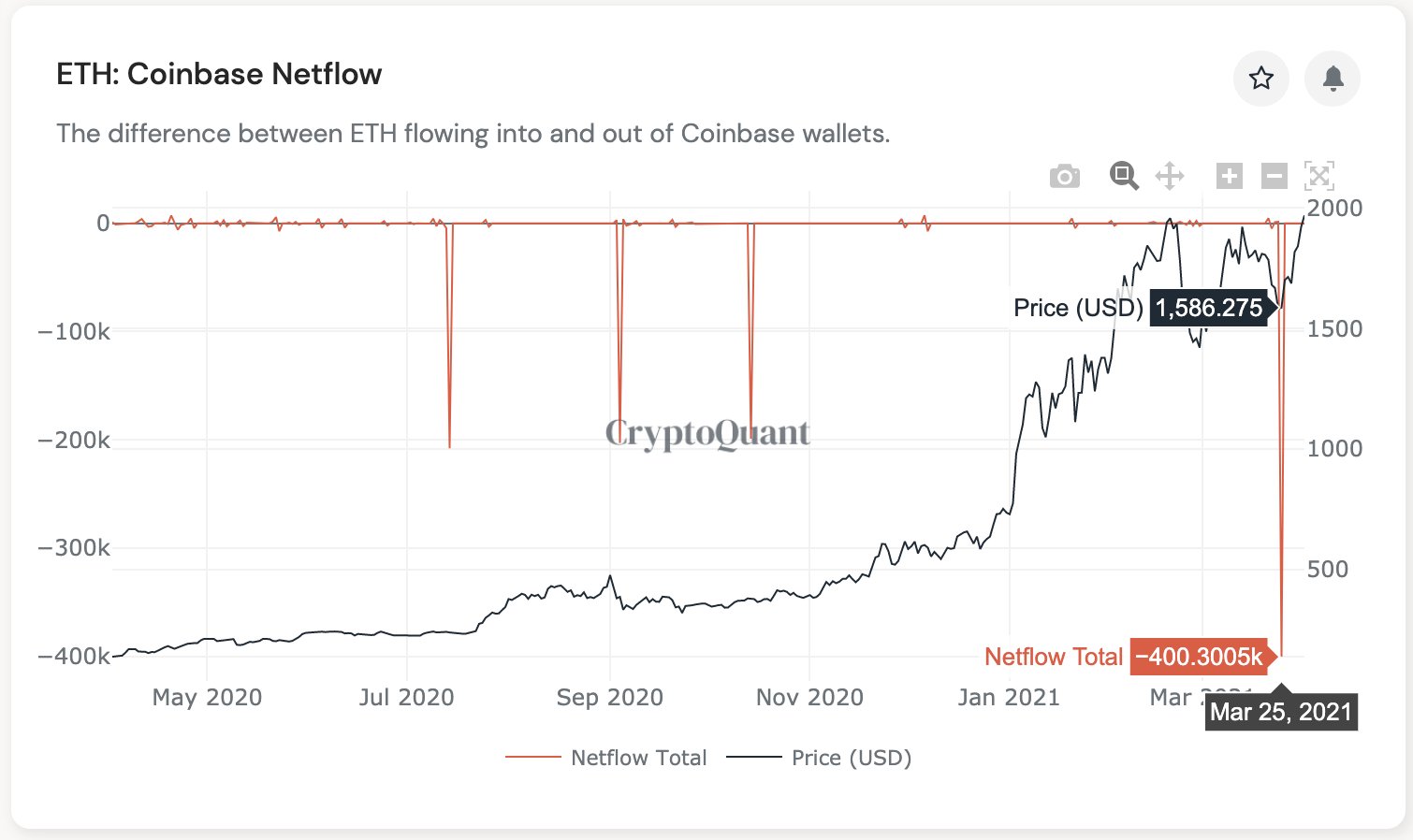

Coinbase Netflow. Courtesy: CryptoQuant

Coinbase Netflow. Courtesy: CryptoQuantKi-Young Ju, CEO of CryptoQuant, noted that Ethereum has been seeing massive exchange outflows in the last couple of days. Earlier this week, Ki noted that 400,000 ETH left Coinbase, which may suggest a surge in institutional interest in ETH. Ethereum options market also depicts a positive outlook. Recently, Glassnode indicated that the total value in the ETH 2.0 deposit contract went above the $7 billion marks.

Traders and analysts believe Ethereum will continue to outperform Bitcoin in April. A pseudonymous trader, Rookie commented on the positive technical market structure of Ethereum while stating that he expects Ethereum to outperform Bitcoin throughout April to June, given the breakout on the ETH/BTC pair.

The view is generally optimistic for Ethereum over the next few months due to EIP-1559 scheduled earlier for July. Cantering Clark, a cryptocurrency trader, and an analyst noted that the Ethereum options market shows big bets heading into June.

Asides from this, the number of active addresses is on the rise with exchange reserves steadily reducing, suggesting increased user activity and demand for ETH. As long as the user activity on the Ethereum blockchain continues to increase alongside important metrics about DeFi on Ethereum, the price of ETH would likely reflect the rising demand for its blockchain network.

Conversely, a correction may be on the cards in the near term if Bitcoin strengthens against Ethereum. In case of possible declines, Ethereum has a strong support level located just above $1,500.

Image Credit: CyptoQuant, Shutterstock

Keep in mind that we may receive commissions when you click our links and make purchases. However, this does not impact our reviews and comparisons. We try our best to keep things fair and balanced, in order to help you make the best choice for you.